Definitions

Eligible Members/Workgroup Members

Individuals who serve on Class One Workgroups and are eligible to receive compensation will be referred to as “eligible members.” When referring to all individuals serving on a workgroup or distinguishing between those who may receive compensation and those who may not, the phrase “workgroup members” will be used in contrast to the phrase “eligible members.”

Workgroup Program Managers

The agency, staff, third-party contractors, and any individuals responsible for supervising workgroup members, issuing payments to eligible members, and establishing rules, procedures, and providing general oversight of the workgroup in question. “Workgroup manager” may not be an official title in every circumstance but generally refers to the people or groups responsible for the management of the workgroup.

Workgroup Classification

Class 1

Any Class One Workgroup, which is defined in 2SSB 5793 as: “Any part-time board, commission, council, committee, or other similar group which is established by the executive, legislative, or judicial branch to participate in state government and which functions primarily in an advisory, coordinating, or planning capacity shall be identified as a class one group. Unless otherwise identified in law, all newly formed and existing groups are a class one group.” When communicating with the public, and soliciting membership and participation on workgroups, state agencies should clearly state which class the workgroup belongs to and what type of compensation and reimbursement the membership is eligible for. If an agency is unsure which class their workgroup(s) belong to, they are encouraged to consult with their Agency-assigned attorney general (AAG) to make a determination. This document pertains only to Class One Workgroups. Other workgroups defined in statute are still required to compensate members but have different payment requirements. Agency staff are encouraged to consult with their AAG to determine which class a workgroup belongs to and ensure that agencies are fulfilling their duty to compensate and reimburse all workgroup members appropriately.

Class 2

RCW 43.03.230 states: “any agricultural commodity board or commission established pursuant to Title 15 or 16 RCW shall be identified as a class two group for purposes of compensation” and “Each member of a class two group is eligible to receive compensation in an amount not to exceed one hundred dollars for each day during which the member attends an official meeting of the group or performs statutorily prescribed duties approved by the chairperson of the group.”

Class 3

RCW 43.03.240 states: “Any part-time, statutory board, commission, council, committee, or other similar group which has rule-making authority, performs quasi-judicial functions, has responsibility for the administration or policy direction of a state agency or program, or performs regulatory or licensing functions with respect to a specific profession, occupation, business, or industry shall be identified as a class three group for purposes of compensation” and “Each member of a class three group is eligible to receive compensation in an amount not to exceed fifty dollars for each day during which the member attends an official meeting of the group or performs statutorily prescribed duties approved by the chairperson of the group.”

Class 4

RCW 43.03.250 states: “A part-time, statutory board, commission, council, committee, or other similar group shall be identified as a class four group for purposes of compensation if the group: (a) Has rulemaking authority, performs quasi-judicial functions, or has responsibility for the administration or policy direction of a state agency or program; (b) Has duties that are deemed by the legislature to be of overriding sensitivity and importance to the public welfare and the operation of state government; and (c) Requires service from its members representing a significant demand on their time that is normally in excess of one hundred hours of meeting time per year” and “Each member of a class four group is eligible to receive compensation in an amount not to exceed one hundred dollars for each day during which the member attends an official meeting of the group or performs statutorily prescribed duties approved by the chairperson of the group.”

Class 5

RCW 43.03.265 “Any part-time commission that has rule-making authority, performs quasi-judicial functions, has responsibility for the policy direction of a health profession credentialing program, and performs regulatory and licensing functions with respect to a health care profession licensed under Title 18 RCW shall be identified as a class five group for purposes of compensation” and “each member of a class five group is eligible to 6 receive compensation in an amount not to exceed two hundred fifty dollars for each day during which the member attends an official meeting of the group or performs statutorily prescribed duties approved by the chairperson of the group.”

Lived Experience

“Lived Experience” refers to direct personal experience relating to the primary subject matter addressed by the workgroup. Workgroups should partner with representatives of historically excluded communities and those who have been disproportionately impacted by policies, processes, and systems that the workgroup seeks to address. These community members have the expertise and perspective necessary to determine what needs to change in our systems to achieve better outcomes. Exactly whose perspectives meet the definition of “lived experience” will depend on the topic and goal of the workgroup. For example, if a workgroup that examines housing instability or the impact of emergency shelters, then those with “lived experience” are those who have utilized emergency shelters or experienced being unhoused. If the focus is to understand challenges of employers who directly work with the unhoused community or at emergency shelters, then it is the employers who have “lived experience.” But if the primary focus is a bit broader, and the goal of the workgroup is examining how services are being both utilized and delivered to those experiencing housing instability, then the definition of “lived experience” may include both recipients of services and the employees delivering the services. See the Community Engagement Toolkit for a deeper dive into the nuance of defining “lived experience."

Low Income

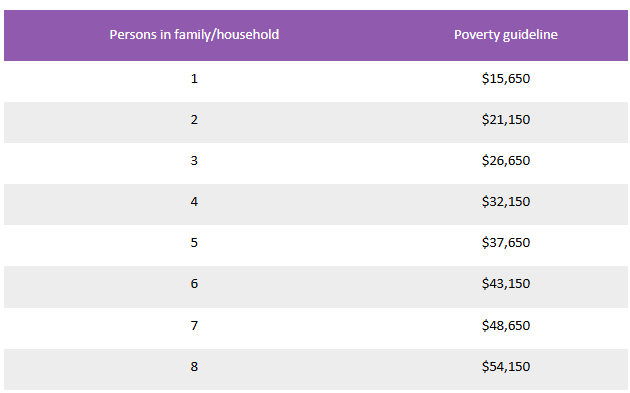

As stated in 2SSB 5793: "Low income" means ‘an individual whose income is not more than 400 percent of the federal poverty level, adjusted for family size.’” The federal poverty amounts are amended annually by the Health and Human Services Department. Refer to the most current year when determining income eligibility for workgroup members.

The 2025 Federal Poverty Guidelines are shown below.

2025 Poverty Guidelines for the 48 Contiguous States and the District of Columbia

CALCULATION EXAMPLES:

- 400% calculation: for a family of four, household income could not exceed $128,600 (4 X $32,150)

- “To calculate the percentage of poverty level, divide income by the poverty guideline and multiply by 100. So, a family of five with an annual income of $80,000 would be calculated to earn ($80,000/$32,470) x 100 = 246% of the federal poverty guidelines for 2022…” - Investopedia

Otherwise Compensated

2SSB 5793 states that workgroup members of low-income status or those who have lived experience may receive compensation “provided that the individuals are not otherwise compensated.”

Being “otherwise compensated” means that the workgroup member is already being paid for their participation in the workgroup by another party and should therefore not be eligible for additional community compensation.

Examples of being “otherwise compensated may include:

- An organization (e.g. foundation, nonprofit, community-based organization) is already offering the workgroup member compensation for their participation.

- Employer of the workgroup member is allowing them to participate during regular work hours and they are not being required to use leave, whether unpaid or paid leave (e.g. vacation time, paid time off) in order to participate.

- Participation in the workgroup is already part of the routine course of the workgroup member’s regular employment.

- Ex: The workgroup member is employed by an environmental nonprofit and is encouraged to serve on environmental policy boards, committees, and workgroups.

- The workgroup member is an independent contractor whose participation in the workgroup is inherent to the contract work they do. Therefore, the workgroup member is currently engaging in paid work that requires them to engage in advocacy or policy expertise concerning the subject of the workgroup, and their participation in the workgroup implicitly overlaps with their existing body of work.

- Ex: The workgroup member is an independent contractor (such as a contract lobbyist or consultant) who has several clients that are paying them to work on solar energy policies, and the contractor joins a solar energy policy workgroup. Regardless of whether they bill hourly for their time spent in the solar energy workgroup meetings (some contract relationships do not bill hourly, but rather have a retainer or lump sum payment), their service on the workgroup would help advance the project that they are already being paid to work on, and therefore presents a risk of the contractor being doubly paid for their time on the workgroup and passing along the benefits of their knowledge and involvement to their client.

Reasonable Allowance

Reasonable allowances include any financial reimbursements for travel, lodging, mileage, and child and adult care. These rates are defined by the Office of Financial Management (OFM). See section on mechanics for stipends and reimbursements for more information on how to implement payments for reimbursable costs. These allowances which cover reimbursements for necessary practical costs incurred in the course of work should not be confused with stipend payments, which are compensation offered for an eligible member’s time, effort, and expertise.

Updates & Periodic Review

Recommended compensation rates for community members are based on various considerations that are impacted by inflation, cost of living, and self-sufficiency standards that are ever-changing and will necessitate ongoing review of these guidelines over time.

EQUITY will update the definition of “low income” annually to ensure compliance with the most current federal poverty guidelines.

EQUITY will also conduct a more substantive review every three years as new Self-Sufficiency Standard reports are published by the UW, and will solicit stakeholder and agency input during this process. EQUITY will create and oversee a system for receiving and incorporating feedback into this document.